Don't be a moron with your money

- richardmartinbarto

- Mar 24

- 5 min read

Only spend within your means and on the things you can afford - pretty sound (and obvious) advice you may say. SO THEN WHY DOESN'T EVERYONE DO THIS? I feel I need to scream from the hills about it.

In the UK, the average household owes £2,471 in credit card debt. In the USA, the average debt is $6,580 per person. Both numbers are too high, but it's shocking how much more debt the average American citizen gets into - highlighting how consumer credit is (even) more engrained into American culture than in the UK. What I don't understand is what everyone can possibly be spending their money on to get into so much debt. Why do people need more and more stuff? So much in fact that they have to spend money they don't have in order to afford it?

Very little of this excess actually makes people happy. There is solid scientific research that proves this. But the debt doesn't stop with credit cards. Oh no.

In the UK, the average car loan was £12,482 in 2023, while more than 2 million cars were bought using finance in the 12 months to May 2024. In the US, average loans were $41,572 for new vehicles and $26,468 for used vehicles in Q4 2024. In the USA, 57.89 million (!) vehicles were sold in 2019 (new and used), of which ~80% were bought using finance.

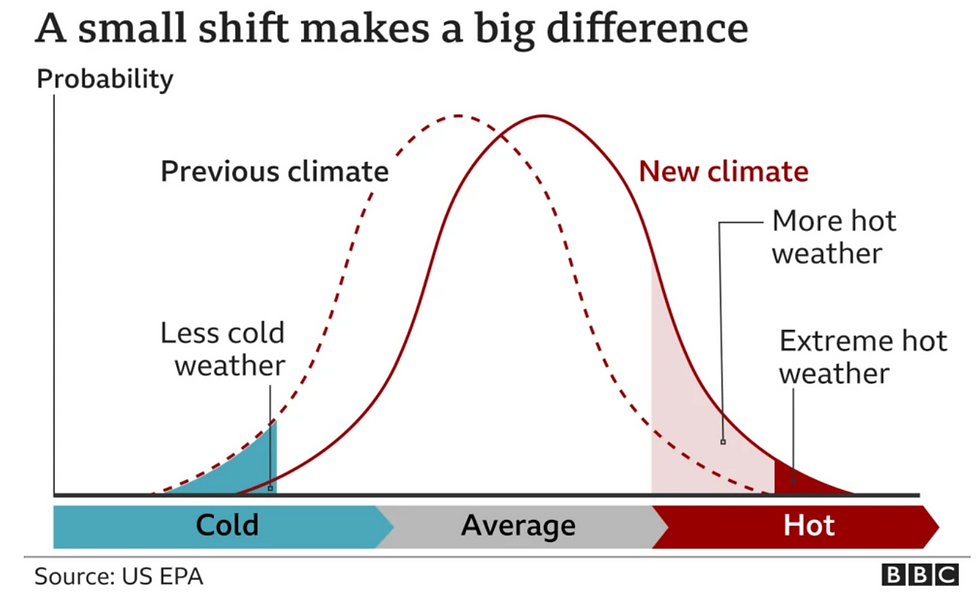

High-interest debt like credit card and automobile loans are a black hole of finance, with interest payments sucking you down, making it more and more difficult to climb out and pay off. The compounding effect of interest payments sucking you down with debt is exactly the opposite of compounding interest driving an investment up and up in value. Which side of the curve do you want to be on?

If you want to avoid getting into debt, don't buy shit you can't afford.

There are some exceptions to this rule:

Houses

The only realistic way for most people to buy a house is through a mortgage, especially with house price increases outstripping wage increases in recent years (especially in the UK). However, before you do go through the hellish home-buying experience, think very carefully about the decision.

Consider phantom costs when buying a home - excess costs and taxes wich accrue during the home-buying process and on an annual basis as a homeowner. Consider the cost of living where you intend to live - ideally move to a lower cost of living area if work permits (or look for a fixer-upper house if that's your thing).

Consider extra taxes (like Stamp Duty in the UK), which also add to the cost of your home, and also consider general maintainence - which you will be financially responsible for. There's no landlord to absorb the cost if anything breaks - it falls on you. Finally, consider the base interest rate set by your country's governing bank - it might be a better time to lock-in a long-term mortgage if the interest rate is low.

However, don't be fooled into buying a house that you might not be able to keep up the mortgage payments on if the interest rate rises - this was one of the fundamental causes of the Cost of Living Crisis in the UK after Covid. Spend some time looking at mortgage calculators and doing the maths to work out the payments in different interest rate scenarios - make sure you can afford it!

There is no set rule on how much of your household income should be spent on housing, although I often see 30% thrown around online. When it comes to the mortgage, make sure you can afford the payments if you or your partner take time off to start a family (or are made redundant). It's in situations like this where your emergency fund should be used.

Education

This is a tender subject, as the cost of higher education varies hugely depending on which country you are from. Everyone should have the right to a good education, and to study what they dream. When it comes to paying for it however, you need to be more pragmatic. Preferably keeping down loans as much as possible - borrowing from the Bank of Mum and Dad would be better (lower interest payments), or taking advantage of any financial gifts from the family.

If you have any savings, now might be a good time to use them. You want to come out of higher education with as little debt as possible; even get a part-time job if you have to (work more during the holidays so it doesn't impact your studying so much). Finally, keep your costs down - if you're a student, you should not be spending £100 regularly on a night out - maybe a few cheap pre-drinks before a couple at the club. Also, you're a student - so you should not be eating out and relying on expensive take-away meals (which are also extremely unhealthy). Learn how to cook delicious and nutritious food - a skill which you can take forward and build on for the rest of your life.

An Alternative Viewpoint

How happy will this thing make me? That's the question you should always ask before making a purchase. Forget do I really need it? - not all purchases are needs, some are wants. That's fine, you're allowed to want things - but will it make you happy? If it doesn't what's the point in buying it? I find that a lot of things I buy rarely make me happy in the long-run. There is a tendency for this effect to work with negative life events too - with time, one's happiness will tend to the baseline following both positive and negative life events. The psychology is called Hedonic Adaptation:

So it's difficult for most purchases to make you happy in the long-term. You can extend the tail of the happiness curve a bit by consciously reminding yourself to be grateful for that new thing every time you use it - but even so, with time your happiness will eventually tend to the base state.

If you live within your means and only spend on the things you can afford, you will find your happiness increases over time because of the added financial security generated from the extra income you save. This is a vastly under-appreciated factor in happiness and mental health.

There are two financial escalators in life - the debt escalator, which forever takes you downwards and one where you have to constantly keep moving just to remain in the same place, and the investment escalator - which forever takes you upwards on the road to success - and any further steps forward you take are compounded by the momentum already behind you! I know which one I want to be on.

Commentaires